GNG Electronics IPO 2025 has captured investors’ attention with strong grey market interest and robust subscription numbers on Day 1. Backed by consistent growth and leadership in the refurbished electronics sector, the IPO is seen as one of the most promising SME offerings of the year.

GNG Electronics IPO is a bookbuilding of Rs. 460.43 crores. The issue is a combination of fresh issue of 1.69 crore shares aggregating to Rs. 400.00 crores and offer for sale of 0.26 crore shares aggregating to Rs. 60.44 crores.

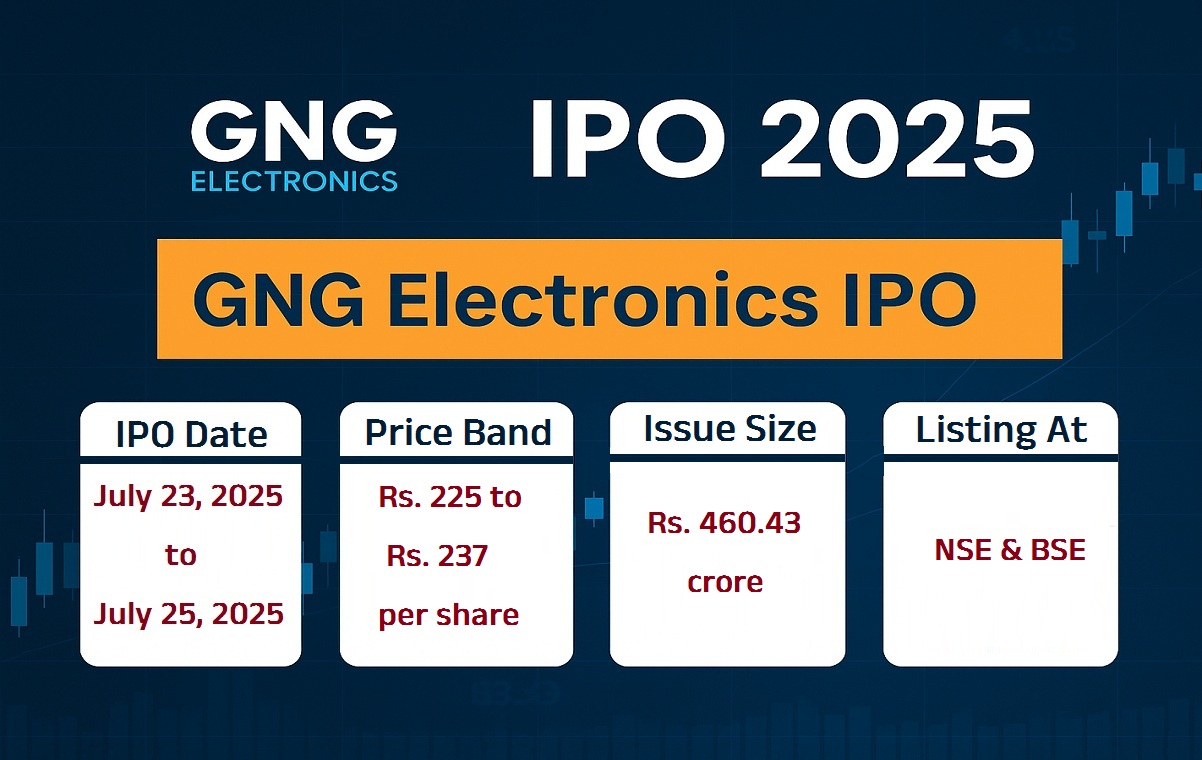

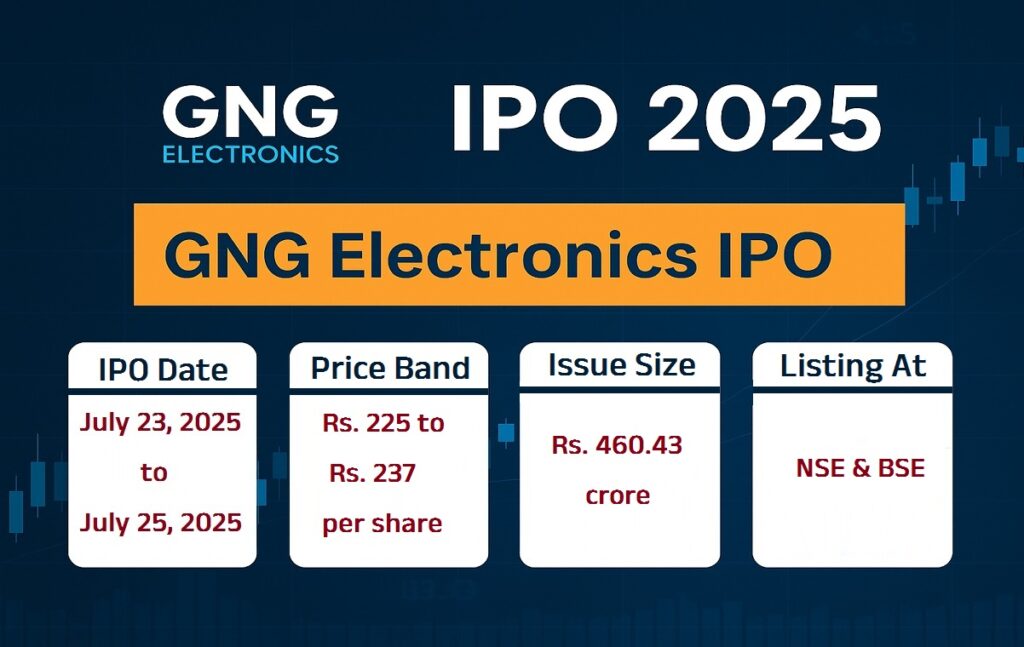

GNG Electronics IPO-Overview

| Details | Information |

|---|---|

| IPO Date | July 23, 2025 to July 25, 2025 |

| Face Value | Rs. 2 per Share |

| Price Band | Rs. 225 to Rs. 237 per share |

| Lot Size | 63 shares (Rs. 14,931 minimum investment) |

| Issue Size | Rs. 460.43 crore (Rs. 400 cr Fresh + Rs. 60.43 cr OFS) |

| Listing At | NSE & BSE |

| IPO Allotment Date | July 28, 2025 |

| Listing Date | July 30, 2025 (Tentative) |

The total issue size of GNG Electronics IPO is Rs. 460.43 crore, comprising a fresh issue of Rs. 400 crore and an Offer for Sale (OFS) worth Rs. 60.43 crore. Based on the upper price band of Rs. 237 per share, the IPO will issue approximately 1.94 crore equity shares in total. This includes around 1.688 crore shares under the fresh issue and 25.5 lakh shares through OFS by existing promoters. The funds raised through the fresh issue will be primarily used for repayment of existing borrowings, working capital needs, and general corporate purposes. The Offer for Sale portion will not benefit the company directly, as proceeds will go to the selling shareholders.

GNG Electronics IPO Issue Size

| Component | Number of Shares | Amount |

|---|---|---|

| Fresh Issue | 1,68,77,637 Shares | Rs. 400 Cr |

| Offer for Sale (OFS) | 25,50,000* Shares | Rs. 60.43 Cr |

| Total | 1,94,27,637 Shares | Rs. 460.43 Cr |

About GNG Electronics Ltd

GNG Electronics Limited, incorporated in 2006, is a leading player in the refurbished IT device market under the brand name “Electronics Bazaar”. The company operates globally with refurbishing centers across India and a customer base spanning 38+ countries.

Products & Services

- Refurbished laptops, desktops, tablets, smartphones, servers

- Value-added services: sourcing, repair, warranty, logistics

Market Presence

- Operations in India, USA, Europe, Africa, UAE

- Five large refurbishing centers

- B2B and B2C clients

GNG Electronics IPO GMP Today (Grey Market Premium)

As of July 24, 2025, the GMP for GNG Electronics IPO is ₹103–₹105. This implies a strong listing premium of over 44%.

| Detail | Value |

|---|---|

| GMP (Grey Market Premium) | Rs. 103–Rs. 105 |

| Estimated Listing Price | Rs. 237 + Rs. 105 = Rs. 342 |

| Expected Gain | Rs. 105 per share (~44%) |

Key Dates to Remember

| Event | Date |

|---|---|

| IPO Open Date | July 23, 2025, Wednesday |

| IPO Closes Date | July 25, 2025, Friday |

| Tentative Allotment | July 28, 2025, Monday |

| Refunds Initiated | July 29, 2025, Tuesday |

| Shares Credited to Demat | July 29, 2025, Tuesday |

| Listing Date Tentative | July 30, 2025, Wednesday |

FAQs – GNG Electronics IPO

1. What is the GNG Electronics IPO GMP today?

Ans. The GMP is around Rs. 103–Rs. 105 per share.

2. What is the IPO price band?

Ans. The price band is Rs. 225 to Rs. 237 per share.

3. Is GNG Electronics IPO good to buy?

Ans. Based on GMP, financials, and expert views, it is considered a “Subscribe” for both listing gains and long-term potential.

4. What is GNG Electronics’ business model?

Ans. It refurbishes and sells ICT devices like laptops, smartphones, desktops, and servers in over 38 countries.